Florida, known for its sunny beaches and vibrant cities, also offers a unique landscape when it comes to sales tax. Understanding the nuances of Florida's sales tax system can be crucial for both residents and visitors alike. Whether you're planning a shopping spree or running a business, knowing how much you'll pay in taxes can help you budget more effectively.

In Seminole County, the sales tax rates have seen some changes recently that are worth exploring. As we delve into the specifics of Seminole County's sales tax rates and savings tips for 2023, this guide will provide valuable insights into how these changes might affect your wallet. Let's take a closer look at what you need to know to make informed financial decisions.

The minimum combined 2025 sales tax rate for Seminole County, Florida is 7.0%. This total includes state, county, and city sales tax rates. The Florida sales tax structure ensures that all transactions within the state adhere to a standardized tax framework. Understanding this combined rate helps consumers anticipate their total costs accurately.

Seminole County Sales Tax Dynamics

Effective June 1, 2024, the State of Florida's sales tax rate on commercial activities in Seminole County will see further reductions. This change aims to boost economic activity by making goods and services more affordable. Businesses operating in Seminole County stand to benefit from these adjustments, as lower tax rates can lead to increased consumer spending.

For instance, Volusia County has a slightly different rate at 2.5%, illustrating the variation across neighboring regions. These differences highlight the importance of staying informed about local tax laws, especially for businesses with operations spanning multiple counties.

As part of ongoing fiscal reforms, Florida continues to adjust its tax policies to align with economic needs and public demands. Keeping track of these updates ensures that both residents and businesses can plan their finances accordingly.

Infrastructure Funding Through Sales Tax

Seminole County's one cent infrastructure sales tax plays a significant role in funding essential projects. Approximately 20%-30% of this revenue is estimated to come from tourists rather than residents, according to the Florida Department of Revenue. This means that visitors contribute significantly to the local economy through their purchases.

Since 1991 and 2001, previous sales tax referendums have successfully funded over 860 new capital projects. These include improvements to roads, schools, and other critical infrastructure. By continuing this initiative, Seminole County aims to maintain and enhance its facilities to meet growing community needs.

This penny sales tax not only supports current infrastructure but also lays the groundwork for future developments. Residents benefit directly from improved public services while enjoying competitive property tax rates compared to potential alternatives.

Tax Deed Sales Process

Tax deed sales in Seminole County are governed by Chapter 197 of the Florida Statutes. The process involves a tax certificate holder applying for a tax deed after certain conditions are met. Once approved, the clerk conducts an auction where interested parties bid on properties with outstanding taxes.

The highest bidder at the sale receives the property title upon payment of all applicable fees and taxes. This mechanism provides an opportunity for investors to acquire real estate at potentially reduced prices while ensuring counties recover lost revenues due to unpaid taxes.

Understanding the intricacies of tax deed sales can be beneficial for those looking to expand their property portfolios. It also underscores the importance of timely tax payments to avoid losing valuable assets through foreclosure proceedings.

Penny Sales Tax Renewal Debate

The question of whether to renew the penny sales tax in Seminole County remains a topic of debate among policymakers and residents alike. With estimates projecting an impact of $842 million, the decision carries substantial implications for local infrastructure funding.

New state laws have introduced additional challenges to campaigning for such measures, requiring greater transparency and accountability in how funds are allocated. Despite these hurdles, many believe that maintaining the current rate is vital for sustaining necessary public services without burdening homeowners with higher property taxes.

Public opinion plays a crucial role in shaping the outcome of these discussions. Engaging communities in meaningful dialogue about the benefits and drawbacks of extending the penny sales tax can foster informed decision-making processes moving forward.

Revenue Impact on Homeowners

According to assessments by the Florida Department of Revenue, between 20% to 30% of sales tax revenue generated in Seminole County originates from non-residents. This indicates that tourism contributes significantly to the local economy, alleviating some pressure on resident taxpayers.

Commissioners argue that continuing the one-penny sales tax could save homeowners hundreds annually by preventing increases in property taxes. To achieve equivalent revenue solely through property taxes would necessitate raising millage rates by approximately 1.2 mills, resulting in an extra $445 per year for average households.

By preserving the existing sales tax structure, Seminole County seeks to balance fiscal responsibility with equitable distribution of tax burdens across different demographic groups. Such strategies aim to ensure sustainable growth while minimizing adverse effects on any single segment of society.

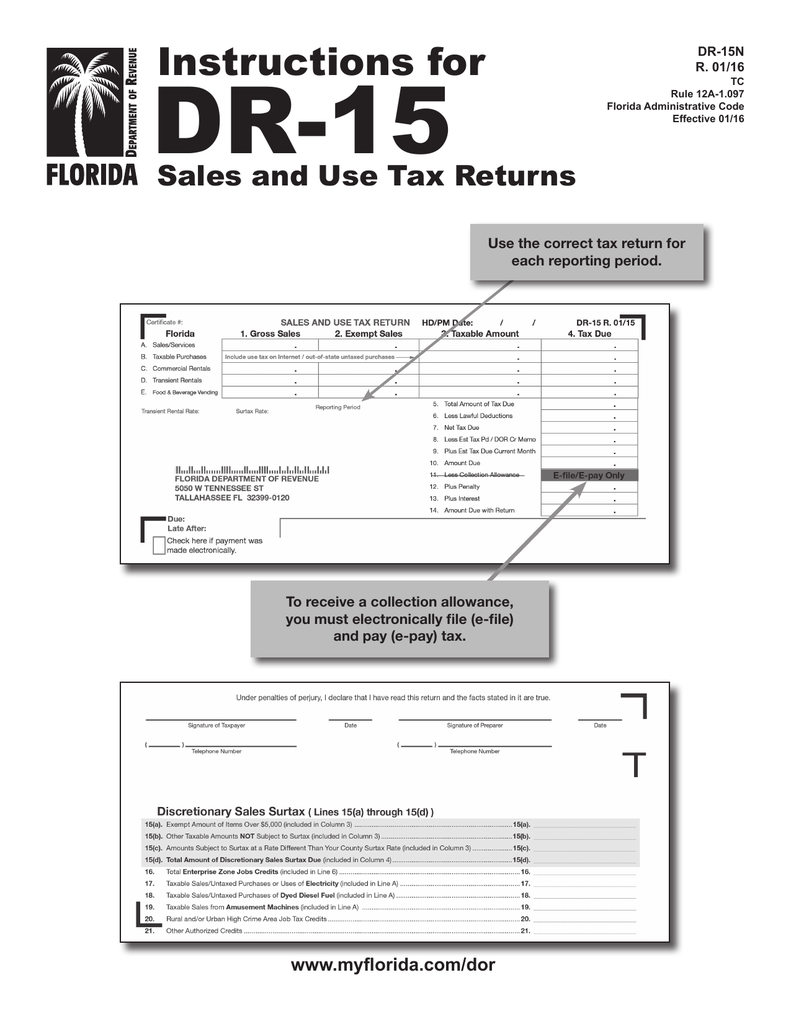

County Discretionary Sales Surtax Overview

The discretionary sales surtax rate varies across Florida counties, including Hamilton, Marion, Martin, and Seminole. Regular updates to these rates reflect changing economic conditions and legislative priorities. Staying informed about these fluctuations allows stakeholders to adapt their financial strategies effectively.

Accessing up-to-date information from official sources like the Florida Department of Revenue ensures accuracy and reliability in planning. For businesses operating across multiple jurisdictions, understanding regional differences becomes even more critical to optimizing operational efficiency.

With continuous advancements in technology and communication tools, obtaining accurate data on sales tax rates has never been easier. Leveraging these resources empowers individuals and organizations alike to navigate complex tax landscapes confidently and competently.